The Rise of the AI Mega-Campus: What Vantage's $25B Texas Bet Really Means

The recent announcement of Vantage's $25 billion, 1.4-gigawatt "Frontier" campus in Texas is more than just another large-scale development; it's a clear signal of a fundamental shift in the data center industry. To understand the future of AI infrastructure, one must look beyond the headline numbers and analyze the powerful strategic drivers that are making the "mega-campus" the new standard.

These projects are no longer being planned like traditional real estate developments. They are being conceived and executed like pieces of critical public utility infrastructure, and for good reason. The move towards this massive scale is a direct response to the three biggest challenges facing the industry: power, supply chain, and competition.

The Power Play

The primary driver for the mega-campus is the ability to co-locate with, and in some cases control, power generation. For a standard 100MW data center, the operator is a guest on the local utility's grid. For a 1.4GW mega-campus, the operator becomes the grid's anchor tenant, with the scale and leverage to fundamentally shape its future.

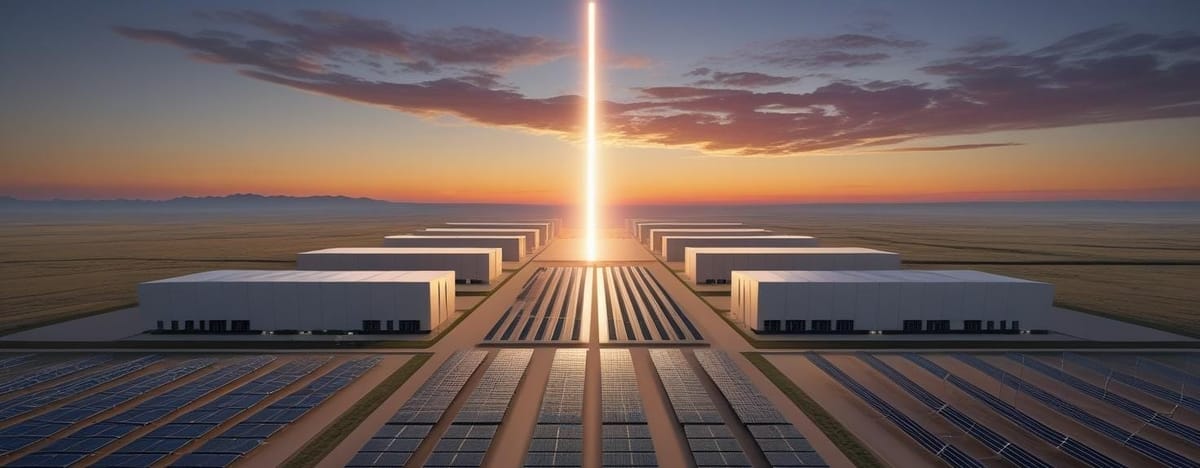

A project of this magnitude makes it financially viable to build dedicated, on-site power sources, such as massive solar farms or long-duration battery storage. This effectively de-risks the project from the volatility of the public grid and insulates it from the permitting and transmission bottlenecks that are stalling development in other markets. It's a strategic move to turn a data center's greatest liability—its dependence on the grid—into a self-contained, controllable asset.

The Supply Chain Advantage

The second, less obvious advantage of the mega-campus is the immense efficiency it brings to the supply chain. Building ten 140MW data centers in a single, coordinated project allows operators to create an industrialized, assembly-line-like construction process.

This scale enables them to place massive, multi-year orders for critical hardware like electrical switchgear, generators, and cooling systems—the very components that are currently facing 80+ week lead times. This gives them immense negotiating power with suppliers like Eaton and Vertiv, allowing them to lock in pricing and, more importantly, secure their place at the front of the production line. While smaller developers are fighting for individual components on the open market, mega-campus operators are creating their own dedicated supply chains.

Conclusion: A New Moat

The AI mega-campus is the industry's response to the unprecedented demands of the AI era. It creates a new competitive "moat" that is nearly impossible for smaller players to cross. The ability to control power, command the supply chain, and deliver massive capacity in a single, integrated location is a strategic advantage that will define the market for the next decade. Vantage's Texas bet is a clear indication that the future of the data center industry is not just big; it's gigantic.